About Us

We know how important it is for you and your family to enjoy life without being held back by credit issues.

That’s why we’re here — to use our knowledge and experience to help you rebuild, restore, and improve your credit score, so you can get back to living life on your terms.

Our mission is simple: to help you regain control of your financial future.

We do this by guiding you through the process of repairing your credit, rebuilding your financial habits, settling debts when needed, and dealing with debt collectors. We believe that when you understand how credit works, you’re better equipped to take charge of it.

You don’t have to face the credit repair process alone.

It can be overwhelming to figure out the rules and regulations around collectors, creditors, and credit bureaus. That’s where we come in — we handle the heavy lifting so you can focus on your goals and finally start getting approved again.

Our Commitment

Our Mission

Weekly Education

Weekly Education

Our mission is to empower individuals by rebuilding and restoring their credit, providing the tools and guidance needed to achieve long-term financial stability and confidence.

Weekly Education

Weekly Education

Weekly Education

During the credit restoration process, we will provide you with information and the education you need to continue raising your credit score.

Our Promise

Our Promise

Our Promise

We are dedicated to helping you improve your credit score to start getting you approved once again!

Who Are We?

Our Promise

Our Promise

We’re here to help you take control of your credit by guiding you through the process of rebuilding and restoring it.

Our Achievement

150 Happy Clients

130 Cases Completed

99% Positive Feedback

99% Positive Feedback

11 Certifications

99% Positive Feedback

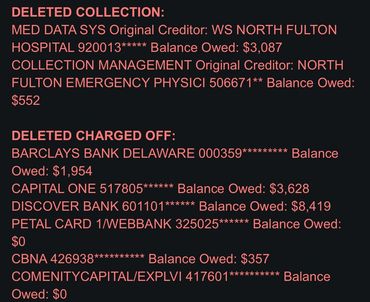

We Find And Fix Errors

Choose Your Plan

Credit Boost Essentials $400 per month. (Month-to-month, no commitment)

6 month Total Credit Restoration $900 one time (Biggest savings! Save $1500)

Credit Boost Essentials $400 per month. (Month-to-month, no commitment)

Month -To-Month

- Credit Education

- 3 Bureau Analysis

- Personalized Dispute Letters

- Client Portal Access

- Monthly Updates

- Money Back Guarantee

90 day Fast Track Restoration $600 one time (Best value! Save $600)

6 month Total Credit Restoration $900 one time (Biggest savings! Save $1500)

Credit Boost Essentials $400 per month. (Month-to-month, no commitment)

BEST VALUE! SAVE $200

- Credit Education

- 3 Bureau Analysis

- Personalized Dispute Letters

- Client Portal Access

- Monthly Updates

- Money Back Guarantee

- Credit Building

- Metro 2 Compliance + Factual Disputing

6 month Total Credit Restoration $900 one time (Biggest savings! Save $1500)

6 month Total Credit Restoration $900 one time (Biggest savings! Save $1500)

6 month Total Credit Restoration $900 one time (Biggest savings! Save $1500)

BIGGEST SAVINGS! SAVE $500

- Credit Education

- 3 Bureau Analysis

- Personalized Dispute Letters

- Client Portal Access

- Monthly Updates

- Money Back Guarantee

- Credit Building

- Metro 2 Compliance + Factual Disputing

- Disputes Secondary Agencies

- Unlimited Disputing

Frequently Asked Questions

Please reach us at quatierra@bosspartners.org if you cannot find an answer to your question.

Yes. In order for me and my team to give you monthly updates and continue to dispute, we will need to monitor your reports. Without the credit monitoring we are unable to keep up with your current results.

When pulling your own credit, it is considered a soft pull which does not affect your credit score. However, when a lender pulls your report, it is considered a hard pull which could cause a slight drop in your score.

We dispute and challenge all negative and derogatory items, as well as any hard inquiries that are not attached to open accounts. You are updated every 35-45 days to show the changes made for each round disputed because the credit reporting agencies have 30 days to respond.

Each credit profile is different so there is no specific timing on the process. The FCRA (Fair Credit Reporting Act) does require the credit reporting agencies to respond in 30 days. The most important part of credit repair is remaining consistent.

You are able to cancel your services at any time without any fees. If you would like to cancel please email us within 48 hours of your due date.

If a client does not see any results within 90 days, you will be issued a full refund. (A refund will not be issued if credit monitoring has not been maintained)

Contact Us

Still have questions?

We know that untangling your credit can be both stressful and confusing. Send us a message today, and we can get you started on a path to financial confidence. Normal response time is within 24 hours.

B.O.S.S. Partners

Hours (EST)

Mon | 09:00 am – 06:00 pm | |

Tue | 09:00 am – 06:00 pm | |

Wed | 09:00 am – 06:00 pm | |

Thu | 09:00 am – 06:00 pm | |

Fri | 09:00 am – 06:00 pm | |

Sat | By Appointment | |

Sun | By Appointment |

Subscribe

Be sure to not miss out on any promotional offers by subscribing to our newsletter!

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.